marin county property tax calculator

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Our Marion County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

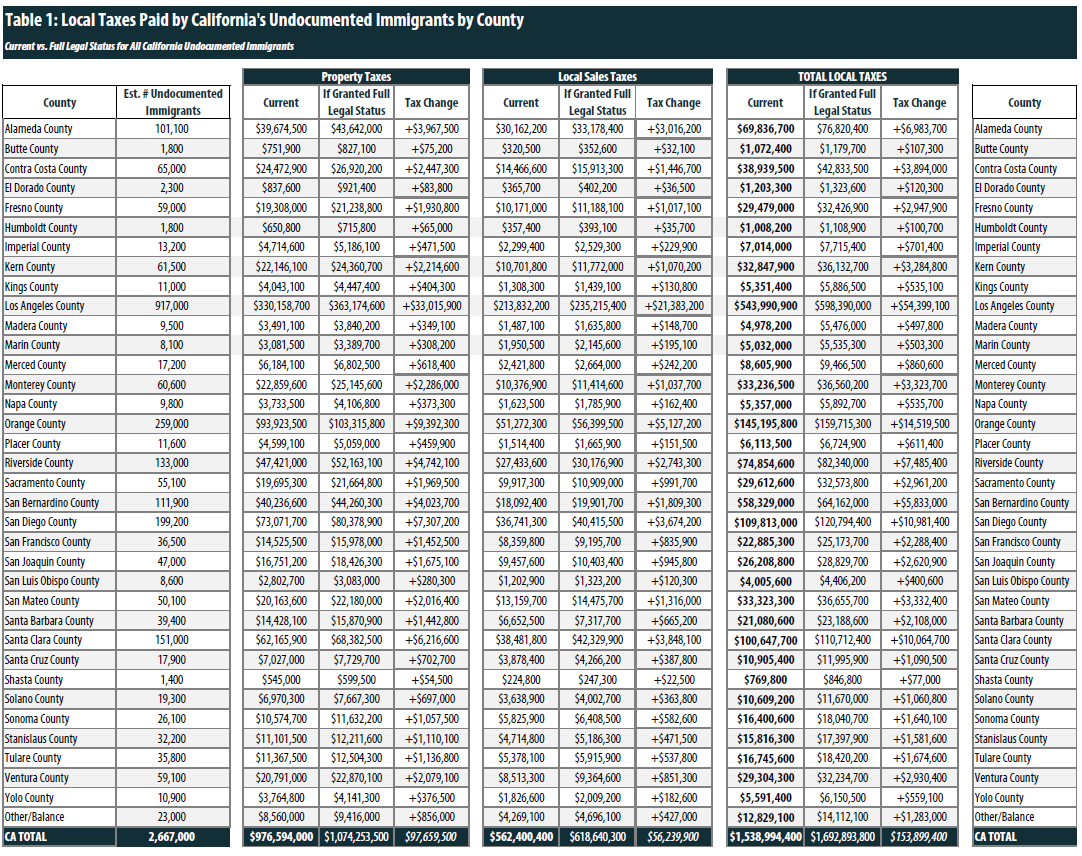

Faqs Assessor Recorder County Clerk County Of Marin

Enter your Home Price and Down Payment in the.

. The supplemental tax bill is in addition to the. The countys average effective property tax rate is 081. Marin county collects very high property taxes and is among the top 25 of counties in the united.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Estimate Property Tax Our Martin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the. Property Tax Bill Information and Due Dates.

If you have questions about the following information. Mina Martinovich Department of Finance. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of.

Tax Rate Book 2018-2019. The Marin County Tax Collector offers electronic payment of property taxes by phone. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

Census Bureau American Community Survey 2006. Martin County Property Appraiser. Tax Rate Book 2019-2020.

The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate. Marin County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent informed about your property levy. Tax Rate Book 2021-2022.

Use this Marin County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance. Secured property tax bills are mailed only once in October. Marin County collects on average 063 of a propertys assessed.

3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608. Secured property taxes are payable in two 2 installments which are due November 1. Tax Rate Book 2017-2018.

Our Marion County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Real Property Searches. Tax Rate Book 2020-2021.

Property Tax Payments Mina Martinovich Department of Finance Telephone Payments. California Property Tax Calculator. An application that allows you to search for property records in the Assessors database.

If you are a person with a disability and require an accommodation to participate in a. Download all California sales tax rates by zip code The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

General information on supplemental assessments and supplemental property tax bills.

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Understanding California S Property Taxes

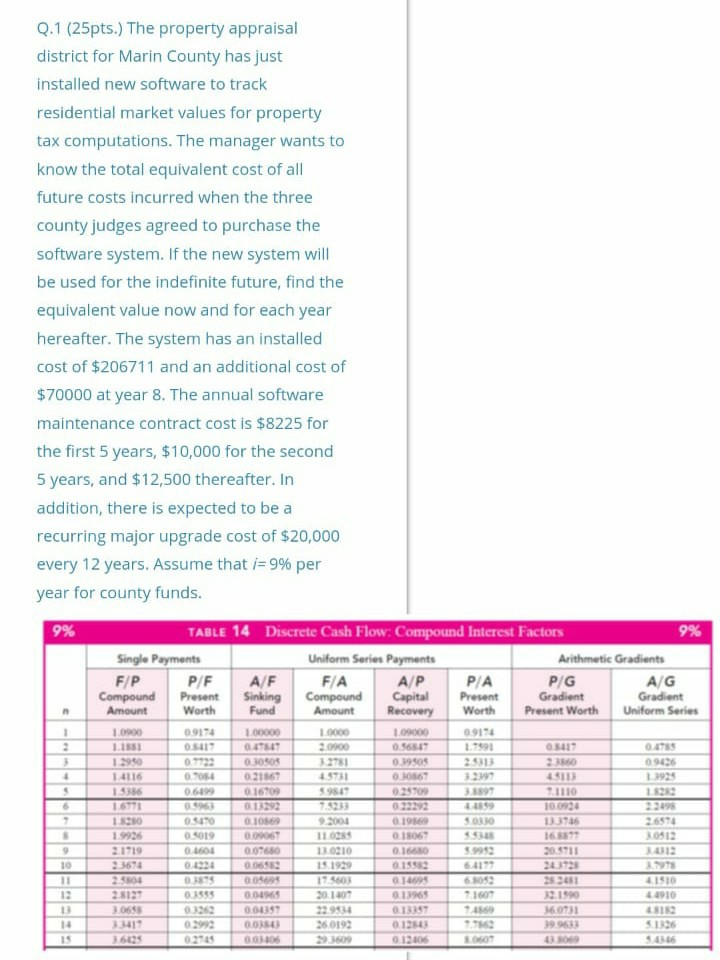

Solved The Property Appraisal District For Marin County Has Chegg Com

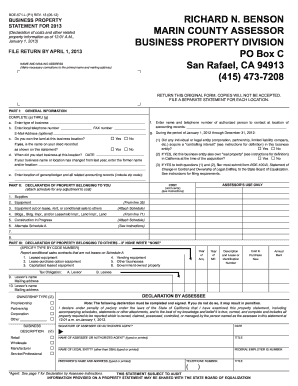

Form 571 L Marin County Fill Out And Sign Printable Pdf Template Signnow

Property Tax Information Town Of Fairfax

Santa Clara County Ca Property Tax Calculator Smartasset

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Comparing Average Property Taxes For All 50 States And D C

Marin Economic Forum Mef Blog Marin Economic Forum

Property Taxes Across The U S Rose To 328 Billion In 2021 Boston Agent Magazine

Property Taxes Increased In Nearly Every State During 2018 Here Are The States That Paid The Most

Marin County Suspends New Short Term Rentals In Western Areas

California Property Tax Calculator Smartasset

California Property Tax Calculator Smartasset